Paid User Acquisition: Are Non-transparent Channels Harming Your Growth?

Paid user acquisition is a crucial part of any app growth strategy. So much, so that very few app developers manage to grow exponentially without investing in user acquisition. However, as much as it is important, for many, it can be complicated to venture into a buzzword-filled world.

Through my 10 years of experience in the digital industry, with eight of these dedicated to mobile marketing, I have seen many advertisers easily get confused by complicated terminology. Or they are closing an eye (sometimes both) by promising to easily reach their marketing objectives at a limited cost (and effort).

In this article, we will walk through the difficult land of mobile acquisition channels. Specifically, taking a look at those risky options out there that can easily harm your company’s growth.

User Acquisition: Why Paid App Marketing Activities?

Before embarking on this journey, we should consider the steps we need to take before starting a paid user acquisition campaign.

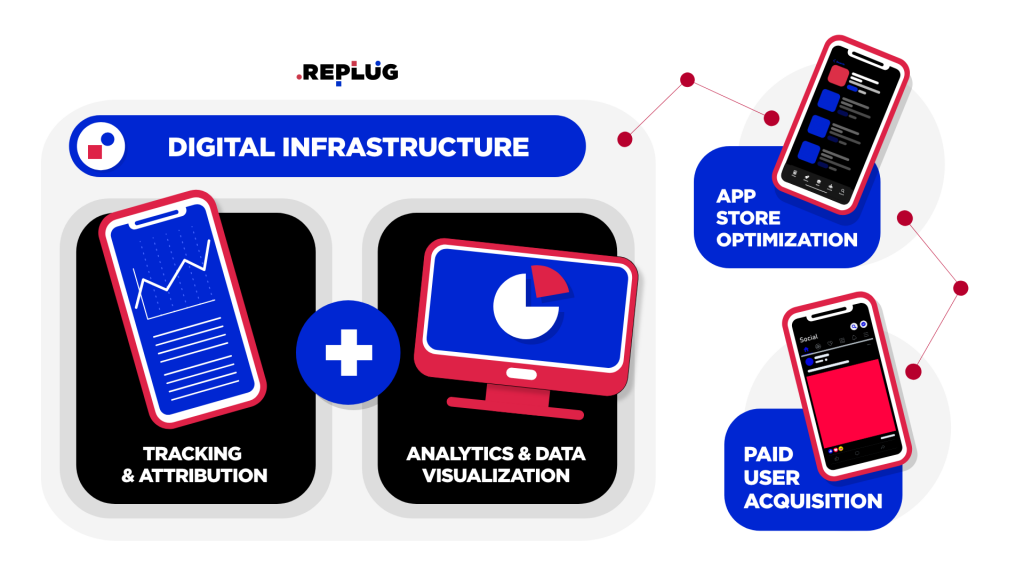

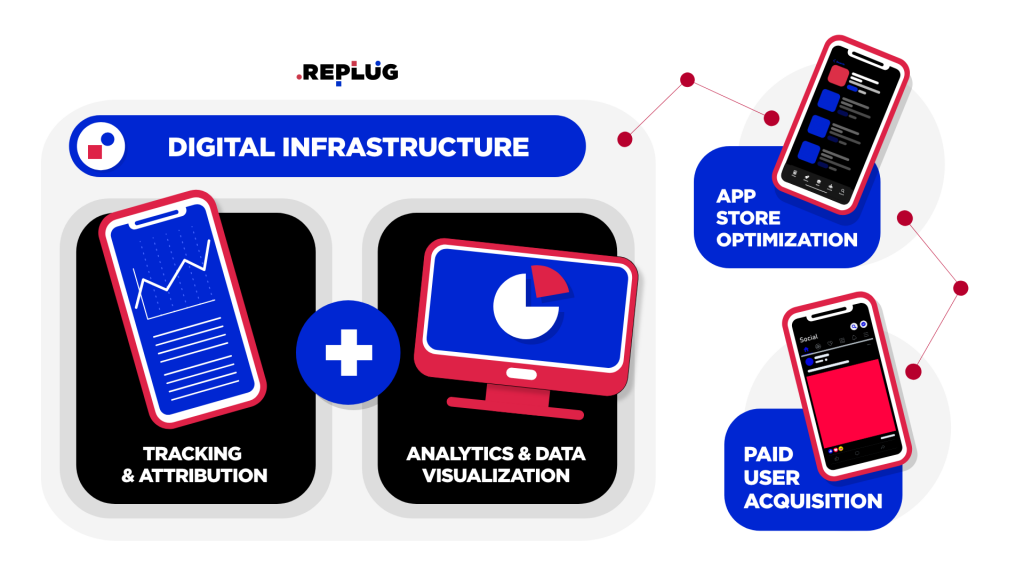

While developing a mobile app, we must choose the right infrastructure to support future marketing activities. The digital infrastructure is the pillar of a successful mobile app growth strategy. Without strong foundations, no buildings can stand, or, as we like to say, no rocket can take off.

Depending on the level of growth that we want to sustain during the months, we need to consider a reliable attribution partner that can help us track all marketing channels. Initially, the natural choice might seem to be Firebase (free and Google-made). However, this has some limitations we cannot ignore when spending on several advertising channels.

When doing paid user acquisition campaigns, we want to use a 3rd party independent platform to track our marketing activities. This means that we cannot rely on the advertising platform of choice for a fair attribution or a tool like Firebase, which cannot track Facebook, for example. These attribution platforms are also known as Mobile Measurement Partners (MMP).

Setting up the right digital infrastructure, with a proper attribution system supported by an analytical tool, is a must-have in the mobile marketing land to ensure we read and understand data in the best way.

Paid User Acquisition: What Are the Options Out There?

There are quite a few options to choose from in the mobile landscape when looking at ways to acquire users. Because of the wide variety of channels available in the market, we can get confused and lose control over our budget.

The best way to start is by choosing those channels that everyone talks about, the “good” ones, so to speak. These are:

Paid Social – Those channels are usually the #1 choice for many advertisers starting out. Especially Facebook and Instagram, because of their massive reach and ease of use. New ones are TikTok and Snapchat, which have taken a lot of interest from more advanced and experienced advertisers.

Paid Search – Those options refer to channels that allow us to bid for specific keywords or search terms. With Apple Search Ads, we can do so directly in the App Store. While with Google and its Google App Campaigns, we can assign some budget to Google Search on their search engine.

Paid Display – Those refer to pure display activities, which are very common on Google App Campaigns (banners, interstitials, or video ads). Here we want to include also the Facebook Audience Network. Although many consider it part of the Facebook platform, it is actually based on display ads on 3rd party mobile apps, using similar options to those of Google.

The Degree of Transparency

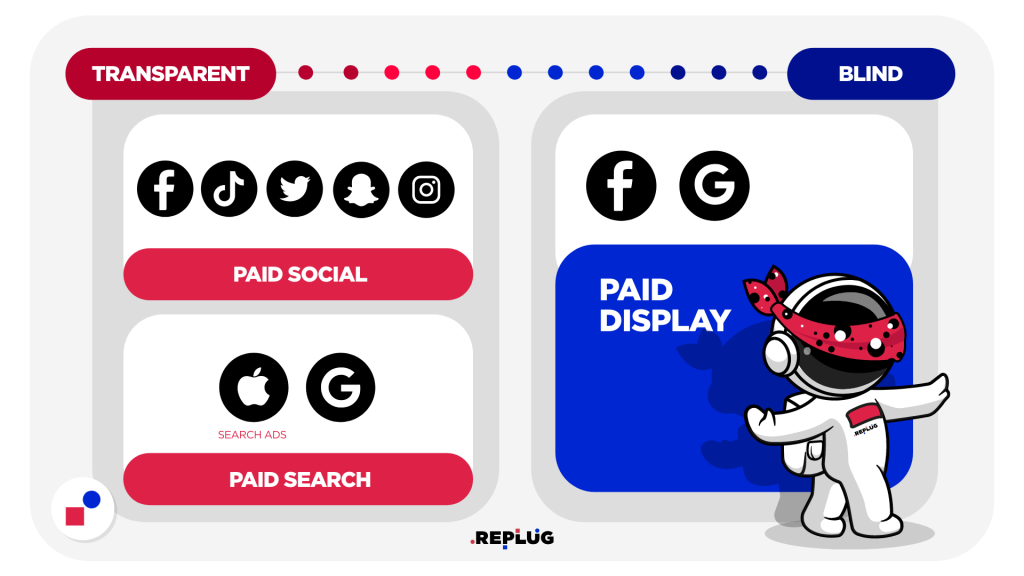

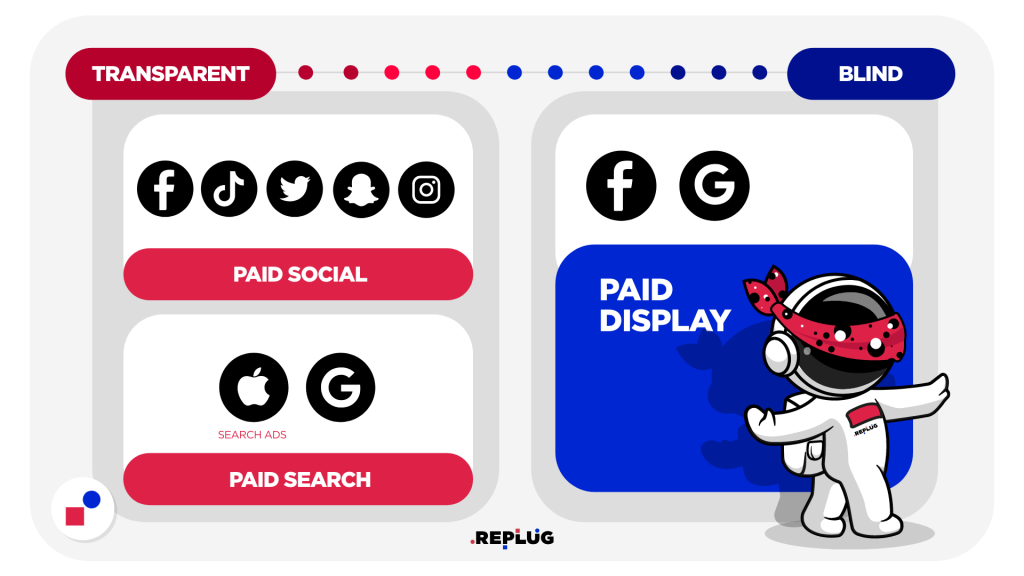

One important question is: What is the degree of transparency I can get on these “good” channels?

The image below represents to what extent an advertiser can “control” where its ads are showing. Both Paid Social and Paid Search offers a “full” transparent model. This is because you know exactly what the placements are and where your potential audience will be finding your ads.

Paid Display, however, is not that controllable. In fact, on Google Display, we can see where (app name) our ads are shown, but we have no control over that. In comparison, the Facebook Audience Network gives us control over categories but no visibility on app names.

AdNetworks, DSPs, Affiliate Networks: What About Those?

The mobile marketing landscape offers more options to “invest” our budget. However, because there are, it doesn’t necessarily mean it’s a good idea to do so. You might get easily confused by those three terms depending on your industry knowledge.

Let’s try to give a bit more context to those players.

Paid User Acquisition: The Three Platforms

AdNetworks – Those are AdTech companies with their SDK (a piece of code to show ads) in various mobile apps in different countries and verticals. The most commonly used AdNetworks (probably the safest) are video networks, such as Applovin, Vungle, AdColony, Unity, and Mintegral. These act somehow to the same level as the Facebook Audience Networks, the only difference being that these show mainly video interstitial and rewarded video ads. Despite being safe, sometimes, we come across stories that make us question the value that they could bring to our media mix.

DSP or Demand Side Platforms – These platforms allow us to buy programmatically on different Ad Exchanges. DSP, as a term, has become widely used in the past few years. So much so that most players today in our industry (without an SDK) claim to have a DSP for programmatic advertising. However, we need to be careful as most companies claim to have proprietary technology while using a 3rd party one.

This is not necessarily a bad thing, but it certainly doesn’t help create a sense of trust when the first claim they make is not entirely true. Normally, DSPs offer either a managed or self-serve option and should, in theory, give us full control and visibility on placements and bids. When this doesn’t happen, we should question whether a DSP is really used for acquisition or it is just a way to disguise other types of traffic.

Affiliate Networks – These are companies that use other affiliates to buy traffic. They usually have no technology whatsoever and offer zero visibility on what they are doing and where they buy from. Because “affiliate” as a term has taken a very bad connotation, nowadays, these companies tend to refer to themselves as simply networks or (even worse) agencies to fool advertisers and app developers.

What Are the Risks of Non-transparent Acquisition Channels?

By now, it should be clear that there are many options out in the market to choose from, and it can be complicated to define a good media mix for our acquisition strategy. At REPLUG, we work exclusively with channels that can offer full transparency and fraud-free traffic to our partners.

Our job as an agency and consultant, but most important partners for our clients, is to teach them about the risk of using non-transparent ways to grow their user base.

When thinking about opening to non-traditional channels, we need to question what are the risks. If we open to traffic options that are not reliable, we will fail at our job as marketing managers. The metrics will be polluted by fraudulent traffic and, most likely, fake users. And we won’t be able to make data-driven decisions.

What About CPA Networks?

This is a fairly recent trend (a couple of years, perhaps). CPA, as a buying model, is relatively common in the desktop space but not so welcome in the mobile one because it is just too complicated to make it work.

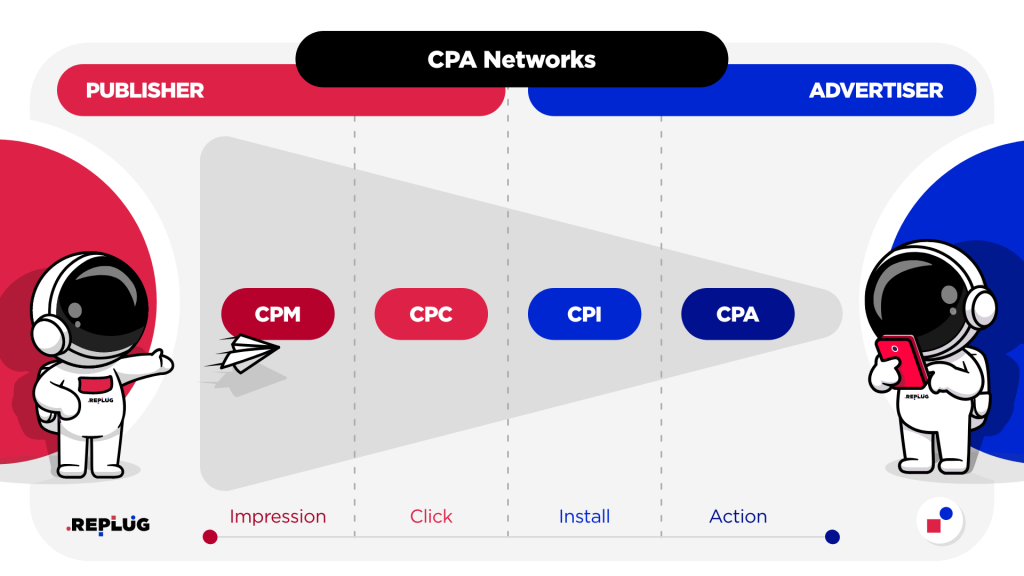

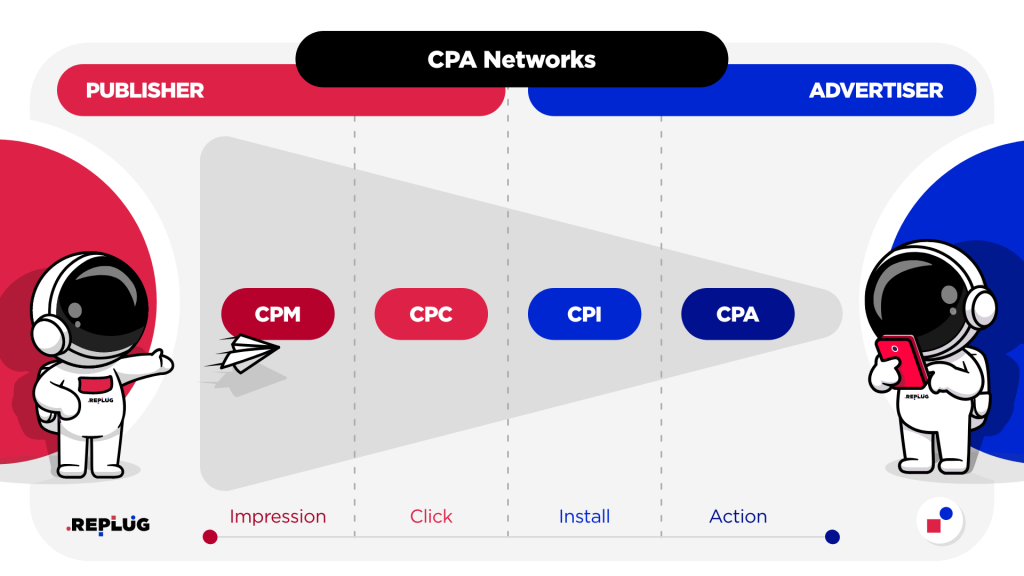

Let’s quickly remind ourselves how the buying-selling process of ad spaces works in terms of costs:

All publishers, i.e., mobile apps, sell their inventory on a CPM basis. It can happen to also monetize through a CPC model (pay-per-click). Conversely, advertisers prefer to buy mobile traffic on fixed costs, such as CPI or CPA, because it’s just less risky.

On those “good” platforms mentioned earlier, advertisers are happy to set a CPI or CPA target cost. This will let the algorithm do the work to optimize CPM/CPC bids to reach that target. Most advertisers understand that it is unlikely to have a fixed CPI/CPA cost in an acquisition campaign as that’s not how it works (considering the continuous creatives and CTAs optimization activities).

However, marketing managers welcome fixed CPAs when buying on less trustworthy platforms because it means zero risks for them – but does it?

It’s Not Economically Sustainable

When buying on (less developed) networks, a common situation is to be flooded with clicks. Clicks everywhere. Millions of clicks per day, but no impressions. The gazillion clicks our ads apparently receive a result in an interesting situation. The conversion rate from click to install is meager. So low, we see at least two zeroes after the comma before a number appears.

Now, without going into the specific situation, I want to make an example similar to a recent case to show how non-sustainable this option is.

Note: The example is simplified for the sake of this article.

Example

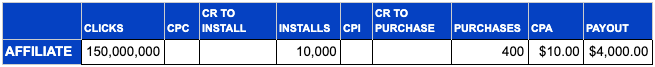

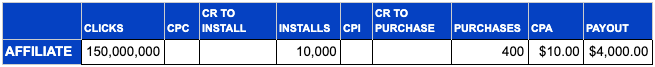

We decided it was a good idea to test a new affiliate that approached us, which claims to have a strong algorithm to optimize acquisition activities directly to the in-app action. We need to grow our numbers, so we give it a try. They say they can get for our shiny new app, a paying user for $10. We are currently seeing on Facebook a CPA (non-cohort) of $15, so we think it might be a good idea to check this out.

Note: The affiliate gets paid exclusively for a purchase.

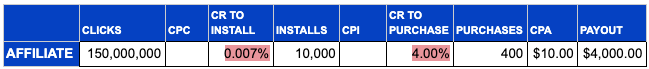

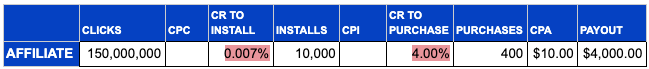

After a month, we have the following situation in our dashboard:

Although we are paying just for the campaign’s outcome, so the purchase, we are a bit worried about the high number of clicks. So we decide to do some math.

We start by taking a look at the conversion rates. First of all, click to install and then install to purchase.

The install-to-purchase conversion rate looks OK and in line with other channels, more or less. However, the click-to-install conversion rate is relatively low. So, we decided to look at the costs to see how much each conversion point (install and click) would have cost if we had paid for them.

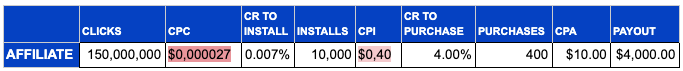

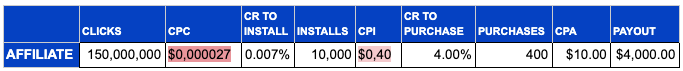

The calculation is a bit of a stretch because we are taking what we pay the affiliate and dividing it by the number of clicks and installs. That already shows a powerful picture, but a CPC of $0,000027. In all this, we are not even considering the affiliate margins, which means that the CPC is even lower.

Looking at these figures, what does that CPA deal look like for you? What kind of inventory is available to buy at that CPC? What about the CPM? Unfortunately, as we don’t get visibility on impressions, we won’t find out that particular point. Still, we can just imagine what that would look like – if any impression was actually ever shown.

Conclusion: It’s Dangerous and It Ruins Our Metrics

Buying this kind of traffic results in a hazardous practice. Placements available at that price are either terrible or simply fraudulent.

When considering fraudulent traffic, we also need to ask ourselves where those conversions are coming from. Are they all fake? Or the affiliate partner was able to “steal” attribution from either organic or other traffic sources?

All these considerations together give us a clear sign of how our metrics will be polluted and wrong when looking at the end-of-the-month reporting.

It’s Not You – It’s Them

Another mistake marketing managers have made to mitigate the fraud issue coming from these types of networks is to instruct them on what metrics they are looking for in terms of conversion rates, the number of clicks, CTIT (click-to-install-time), and more – to accept their conversions as successful ones.

When you give fraudsters instructions, the result is not less fraud, but rather a more complex to spot fraudulent activity. All those metrics mentioned above, as well as publishers’ names, can be controlled manually (technically done by code).

It’s an Additional Cost

You might think this is not a problem for your company because you have decided to implement an anti-fraud tool. The question, however, would be, if you would stick to normal traffic channels, wouldn’t you be able to save this money and test more ideas on “good” channels to achieve your marketing objectives?

Conclusion

The mobile marketing industry is a complicated ocean to navigate. It has been evolving rapidly in the past few years, and non-compliant, fraudulent traffic sources have evolved faster than one might think. Even anti-fraud tools develop solutions that are based on fraudulent activities that have happened already.

They are basically mitigating the problem (and then successfully preventing it). Still, the real issue is that it’s a reactive and not a proactive approach simply because no one knows what fraudsters are thinking next.

Working with an external partner who can guide you in this maze of choices and help you optimize your media buying on “good” channels is paramount as the industry evolves.

At REPLUG, we specialize in paid user acquisition combining over 10 years of experience on both sides of the table, ensuring our partners invest every marketing dollar they have in the best possible way.

Originally published on September 2020, updated on February 15, 2022.

Comments